How to calculate Working Capital

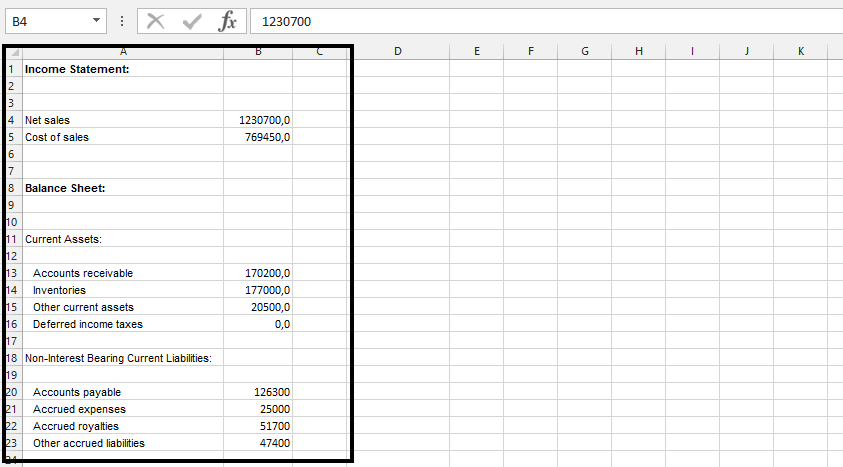

This will look something like this:

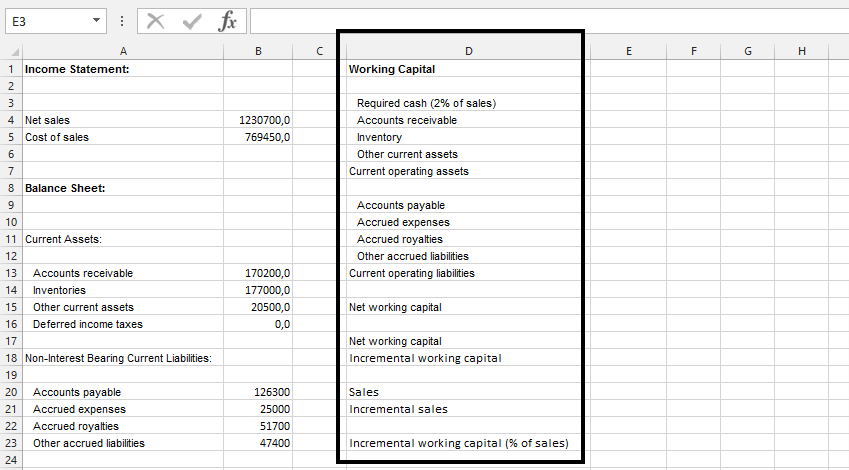

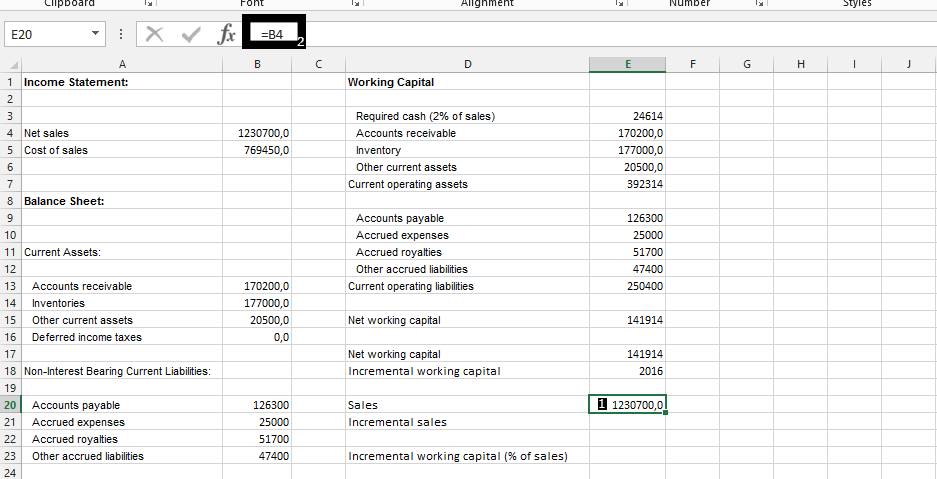

Just make the Working Capital Table, which looks like this:

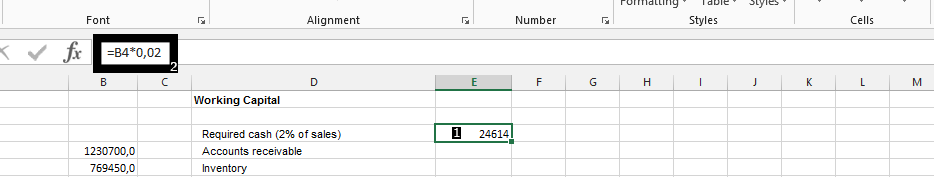

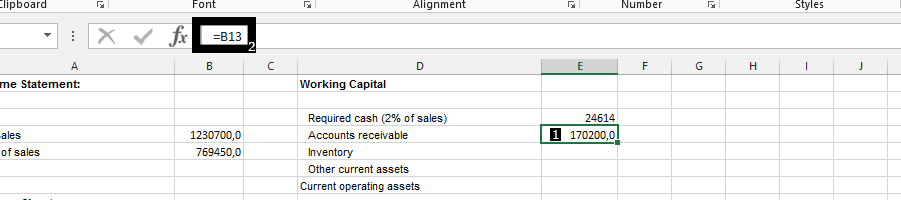

Click on a cell beside Required Cash (1), and multiply B4 with 0,02 (2).

Click beside account receivable (on the working capital table) (1), and type the same value in Income statement (2).

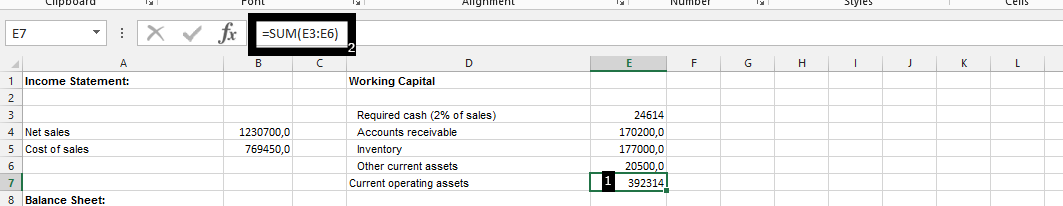

Note: Repeat this step for inventory, and other current assets.

Click beside current operating assets (1), and type =SUM(B3:B6) (2), to calculate it.

Note: Repeat step three for accounts payable, accrued expenses, royalties, other accrued liabilities (put the same value that is in income statement in Working Capital), and use step four to calculate other operating liabilities=SUM(E9:E12).

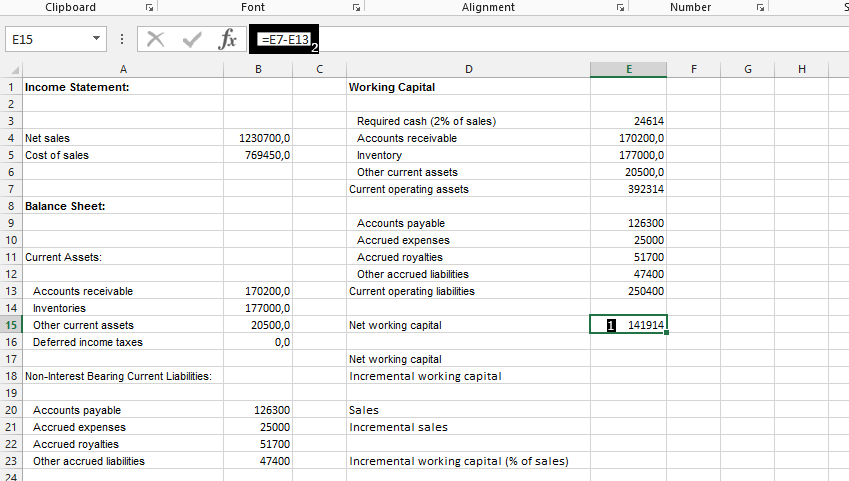

Click beside Net Working Capital (1), and type =E7-E13 (2).

Note: You should put the result on the net networking capital under this step.

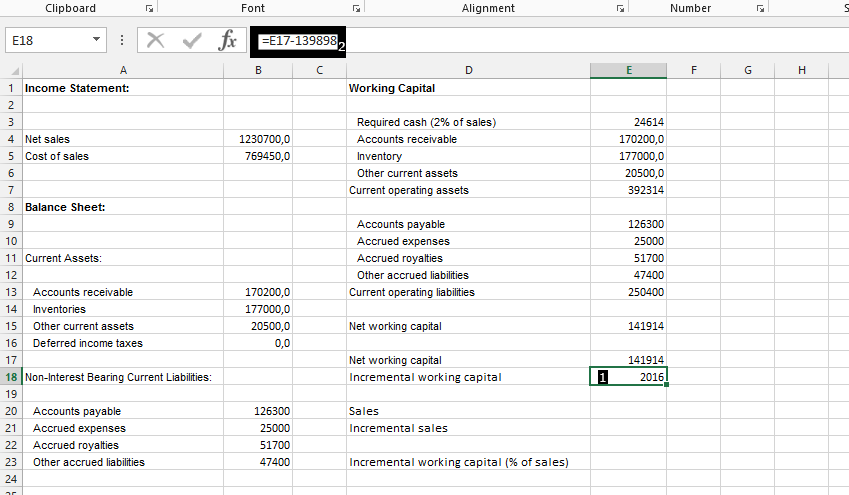

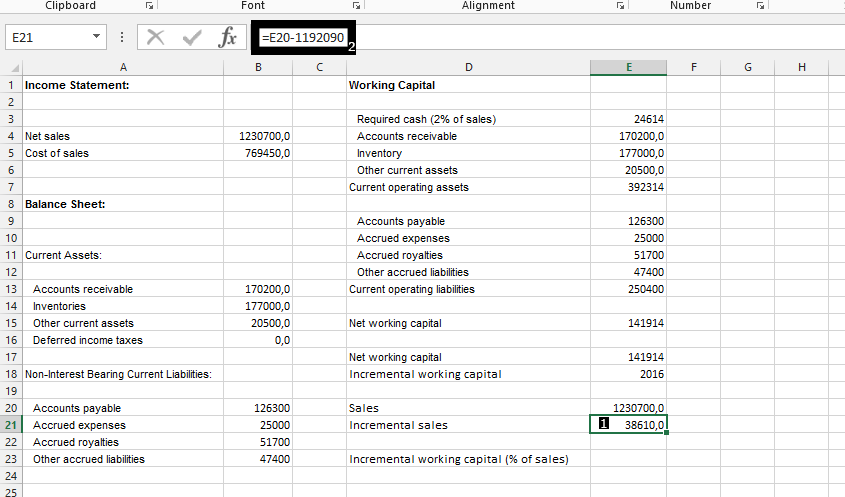

Click beside the incremental working capital (1), and minus the networking capital of the year from the previous one (2).

Click beside the sales (1), and put the same value beside net sales (2).

Click beside sales increment (1), and minus this year’s sales from previous one (2).

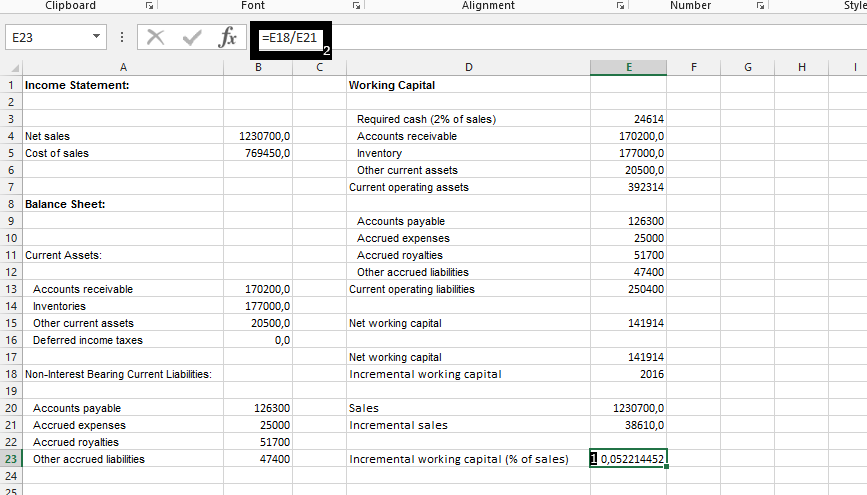

Click beside incremental working capital (1), Divide incremental working capital with the incremental sales (2).

Note: You can now change the format to percentage. By right clicking on the result, choosing format cells, then choose percentage, and click ok.

In conclusion, we have calculated both gross working capital, and net working capital in this calculation.

Template

Further reading: Basic concepts Getting started with Excel Cell References